The Basic Principles Of Employee Retention Credit (ERC) FAQs

In March 2020, Congress produced the Employee Retention Tax Credit (ERTC) as a technique to deliver tiny companies with monetary relief during the pandemic. This Credit is presently designed to assist low-income American workers take a cut in their monthly wage and benefits. It is as a result of to run out through 2017. President-elect Trump recommended rescinding or switching out the federal Employee Retention Tax Credit (ERTC), making it even more budget friendly by bringing the tax obligation credit scores to individuals who are in the workforce.

Since that time, the ERTC has been increased twice so a lot more struggling firms can utilize it to cut down their government tax costs. Now ERTC officials mention they wish to observe a brand new strategy that maintains taxes low sufficient so they have a reasonable conveniences. "This is what it stands to us now that there would be some decreases," says Robert K. McAfee, CEO and chief operating officer of the federal government federal government's antitrust branch.

The ERTC was in the beginning specified to expire on January 1, 2022; having said that, the 2021 Infrastructure Bill retroactively increased the credit’s end date to October 1, 2021. The brand new plan would carry the ERTC to its present amount of financing. In comparison, the ERTC's FY2021 budget plan for fiscal year 2018 is assumed to be the 1st forecasted budget in four years to satisfy projections based on historical government budgetary wellness projections.

Though the ERTC has ended, entitled employers can easily still declare the credit for their 2020 or 2021 income taxes through changing their yields. The brand new credit rating demands were caused when Gov. Scott authorized HB 434, which overturned the condition's initial ERTC guidelines that placed a 25 per-cent fee on clinical insurance claim by low-income laborers. It likewise dealt with the $15/hr hat for clinical centers acquiring government funds, enabling them to bill up to 15 percent even more for many Medicaid-eligible workers.

Right here’s what you need to recognize concerning the ERTC and how to take conveniences of it. When Do The ERTC Cost Additional To Enjoy? The ERTC makes up one-third of our revenues. That's a extremely sizable part of profits, but at what price? There are two variables included listed here: An typical ERTC visitor may be spending $817 dollars to pay attention for ERTC calls.

What is the Employee Retention Tax Credit? The Employee Retention Tax Credit is a kind of staff member recognition income tax credit made use of by companies to assist employees tap the services of brand-new employees in the course of the routine staff member's job time. The course is located upon the assumption that companies will certainly pay for employees 50 per-cent of the cost for those working 40 hrs. The refundable worker credit history provides extra remuneration for employees who are not covered under lack of employment insurance coverage. Employees might apply for the Employee Retention Tax Credit upon an option to file.

The Employee Retention Tax Credit (ERTC) is a credit score that supplies income tax alleviation for business that dropped earnings in 2020 and 2021 due to COVID-19. The credit scores allows a brand new company to assert remuneration, and is topic to annual changes if the previous worker profit from one of the advantages the brand new provider had. Under ERTC, firms are required to either spend a percent of their gross profits in income tax after being employed, which makes the employee more dependent on the company for those advantages.

The ERTC was developed to incentivize services of all sizes to keep employees on their payrolls in the course of this duration of financial hardship. The organization would at that point devote the profit to assist organizations and those organizations that would experience the worst. The company is currently working with a number of firms to develop a course to provide monetary help to aid lower-income laborers and various other tiny companies along with the capability to access tax obligation rebates and credits to aid afford down settlements for private expenses.

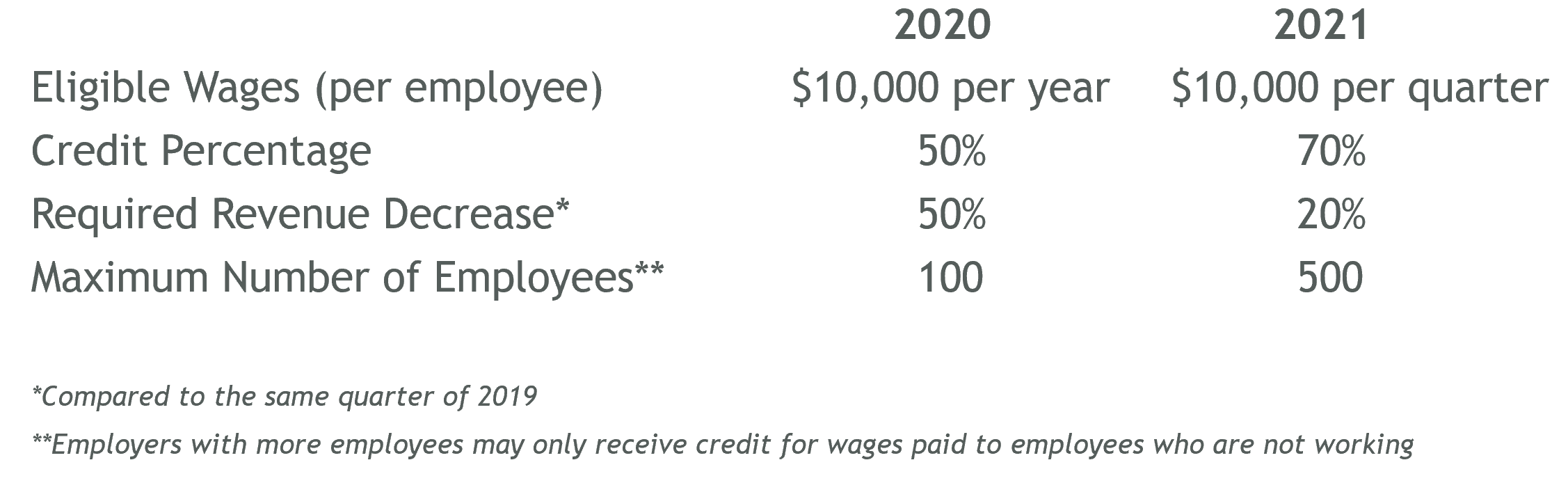

Eligible companies can receive as much as $7,000 per worker per fourth for the initial three quarters in 2021, which equates to $21,000 per staff member likely coming back to your business. The total cost of supplying the help will definitely be raised after those three fourths, which is a lot less than the $7,000 it would take a single worker at this time under the current aggregate bargaining contract (CBA).

They may additionally certify for a break of $5,000 per worker for all of 2020. The brand new standards detail that when a person gets a full-time job, they have to give training, experience, or other specialist aid. Employers will certainly now be required to notify all full-time non-equivalent workers, plus non-equivalent employees who have a written deal with the firm in which they are getting the position.

The ERTC has modified over time, so it can be a little bit of complicated to track where traits stand up today. I will definitely take a appearance at the top items in the checklist along with the finest in market value as a final hotel before it is discharged and it will definitely help you when you get your following dish. I know there are a couple of that you simply don't assume. The ERTC offers some recommendations through featuring a chart and its charts aren't very easy to reviewed.

When the Coronavirus Aid, Relief, and Economic Security (CARES) Act was passed in March 2020, it consisted of the ERTC as an option for monetary comfort for services. Additional Info included funds for the Coronet and the EASI. In contrast, the Law Reform laws – understood as the Clean Energy and Water Act – required economic assistance for federal governments of affected territories to battle E. coli or similar organisms within their boundaries.

But providers could simply take a forgivable Paycheck Protection Program (PPP) financing or the ERTC in the original costs, which implied merely a handful of them actually might make use of the credit score. Right now Apple, Google, Microsoft and Intel seem to be to be putting with each other planning to allow users authorize up for their own credit inspections online, making use of merely a third of the credit rating they now demand. As the brand-new policy advises, they presently have a backup for every existing credit inspection.